|

|||

|---|---|---|---|

|

|

|

|---|---|---|

|

||

|

|

|

|

|---|---|---|

|

How to Improve Your Credit Score: A Comprehensive Guide

Improving your credit score is a journey that requires patience, discipline, and a strategic approach. Credit scores are not just numbers; they are a reflection of your financial health and can significantly impact your ability to secure loans, rent apartments, or even land certain jobs. The journey to a better credit score is a marathon, not a sprint, but with the right steps, you can make significant improvements over time.

First and foremost, you need to understand what makes up your credit score. The most commonly used scoring model, FICO, considers five key components: payment history, amounts owed, length of credit history, new credit, and credit mix. Each of these components plays a vital role in your overall score. Payment history is the most significant factor, accounting for about 35% of your score. This means paying your bills on time is crucial. A single late payment can have a substantial negative impact, so consider setting up automatic payments or reminders to ensure you never miss a due date.

Next, focus on the amounts you owe, which account for roughly 30% of your score. This is often referred to as your credit utilization ratio, a measure of how much credit you are using compared to your total available credit. Ideally, you should aim to keep this ratio below 30%, as high utilization can signal financial distress to lenders. Paying down existing debt and avoiding accumulating new debt can help lower your utilization rate.

The length of your credit history accounts for about 15% of your score. While there's not much you can do to expedite the aging of your credit accounts, you can avoid actions that may inadvertently shorten your credit history, such as closing old accounts. Even if you don't use them frequently, keeping these accounts open can positively influence your score.

New credit and credit mix each make up about 10% of your score. Opening new credit accounts can temporarily lower your score due to the hard inquiries involved, so only apply for new credit when necessary. Maintaining a diverse mix of credit accounts, such as credit cards, mortgages, and installment loans, can also benefit your score, but don't open new accounts just for the sake of diversity.

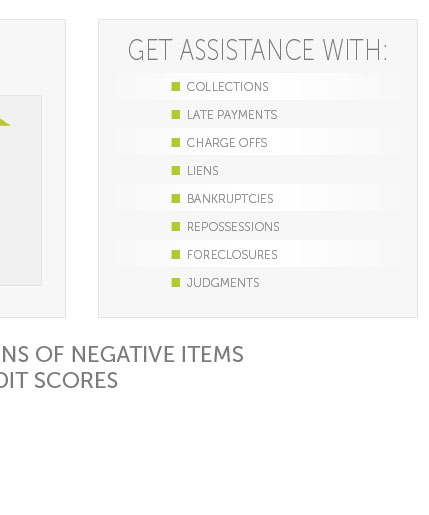

- Check your credit reports regularly: Mistakes on your credit report can unfairly harm your score. You're entitled to a free report from each of the three major credit bureaus annually through AnnualCreditReport.com. Reviewing these reports allows you to catch and dispute errors promptly.

- Consider a secured credit card: If you're struggling to build or rebuild credit, a secured credit card can be a helpful tool. These cards require a deposit that serves as your credit limit, reducing the risk for lenders and offering a stepping stone to better credit.

- Become an authorized user: If you have a trusted family member or friend with a good credit history, consider asking to become an authorized user on their account. This can add positive information to your credit report without requiring you to take on more debt.

Improving your credit score is not just about boosting numbers; it's about building a solid financial foundation. While the steps above are effective, remember that improving your credit is a gradual process. Patience and persistence are key, as is a commitment to responsible financial habits. As you work towards better credit, you'll not only increase your financial opportunities but also gain a greater sense of financial security and independence.

You do not have to pay for "credit repair" to improve your credit. You can get free credit counseling services from a HUD- certified housing counselor or do ...

There are ways to raise your credit score fairly quickly. Some steps take as little as a few minutes.

Increasing your score can make a big difference in getting your mortgage approved and determine if you qualify for the best interest rates.